da-kuk/E+ via Getty Images

Financial Jackson (NYSE:JXN) has performed appallingly since I wrote my last article. The stock is down 34.3% and 33.29% including dividends. Even though I knew the stock would be volatile, I didn’t expect the price drop to be that big. as it has been given how cheap the stock is valued. Jackson said in its first quarter 2022 press release that “youhe lower net income in the current quarter reflects a higher level of embedded derivatives gains in the prior year period due to higher equity market returns, partially offset by lower losses on standalone derivatives in in the current quarter, which also resulted from stronger relative equity market returns in the prior year period.”

I had been watching Jackson closely and bought more JXN on June 15, 2022, on the assumption that a higher quality company now trades for less than the silver on its balance sheet. Although Jackson must have a large cash balance due to the nature of their business, I see any company trading below their cash balance, I consider them very cheap.

Shareholding

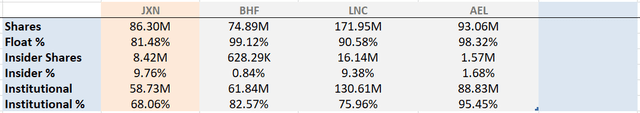

I’d like to start by looking at the ownership structure.

Property Preview (Seeking Alpha)

Jackson has strong insider ownership and a high percentage of institutional ownership. I’m not so much of a fan of large institutional ownership, as these companies usually cause excessive volatility when entering or exiting. Insider ownership is very encouraging, especially when combined with insider buying.

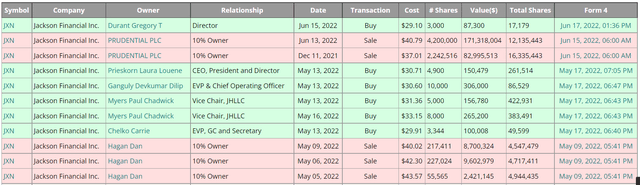

Insider Trading Jackson Financial (Insider Arbitrage)

Dan Hagan has been actively selling his position since the start of 2022 and Prudential PLC (PUK) has said they will look to unload their position at opportune times, which I think creates a headwind for Jackson.

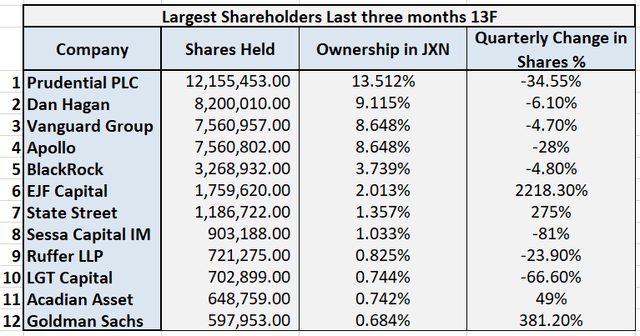

Below, you can examine Jackson’s greatest owners. If our numbers differ, I’ve played around with these numbers a bit by adding the latest published transactions and aggregating them from multiple sources.

Major Owners Jackson Financial (MarketBeat, WhaleWisdom, Insider Arbitrage)

Comparables

For the evaluation, I kept most of the same parameters for people who read my last article to compare where Jackson is today. I added non-GAAP operating profit because it shows a better representation of business operations. I have not removed book value per share for consistency. I also removed AIG and AFG as both companies sold their annuity business to MassMutual. I also added Brighthouse Financial (BHF) which is Jackson’s closest peer.

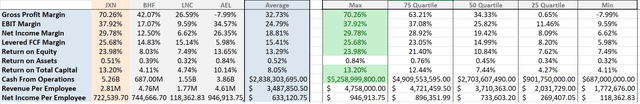

Profitability

Peer-to-peer profitability (looking for Alpha)

Jackson still leads in profitability by a significant margin over its peers with a gap of approximately 28% over its nearest competitor for gross profit margin. Jackson also leads with a net income margin of around 30%.

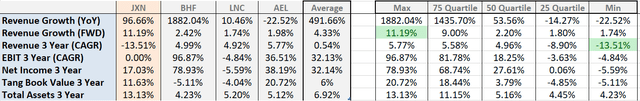

Growth

Peer to Peer Growth (Looking for Alpha)

The growth story has slowed, but the company is still showing strong results. The company is expected to continue growing double-digit revenue. I expect people to start moving away from risky assets and putting their money into minimal risk investments, which makes this growth assumption reasonable. Brighthouse Financial has experienced explosive growth over the past few years, but is expected to slow in the future. I expect pilots that benefit Jackson to also benefit Brighthouse.

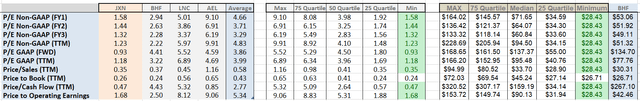

Evaluation

Peer Review (Seeking Alpha)

Jackson is still the cheapest stock in all relevant sections. When comparing Jackson to Brighthouse (the closest peer), Jackson is trading at around half Brighthouse’s valuation. Even looking at the price to operating profit ratio, Jackson still only trades at 1.68x. I still believe this is very low for a top quality boring company. Something not shown in these charts is that Jackson has $2.674 billion in cash and equivalents on their balance sheet and currently has a market capitalization of $2.470 billion. A market capitalization on cash and cash equivalents of 0.92x.

Catalysts

Returns to shareholders

Jackson aims to return between $425 million and $525 million to shareholders this year. That’s roughly the equivalent of 17-21.5% of the business in a year. Shareholder returns consist of a quarterly dividend of $0.55 yielding a yield of approximately 7% and a share buyback up to $338 million.

Rate hike

Annuity companies generally perform better in a rising rate environment because their products will generate a higher return for customers, making them more attractive. At the same time, annuities are often preferred to bonds because their price does not drop like bonds do in a rising rate environment. As central banks in the Western world raise the overnight rate, they saw the yield on annuities rise, which should lead to new inflows into annuities.

Geopolitical uncertainty

Additional demand is being created by market instability and geopolitical uncertainty as investors seek safe havens. As the Russian-Ukrainian conflict continues and tensions continue to rise, investors should continue to seek safety. Annuities are comparable to a life insurance policy in terms of security. For many investors who want income from their portfolio, an annuity makes more sense than a life insurance policy. An annuity also tends to hold its value better than bonds. These factors are attractive to investors and savers with a low tolerance for risk.

Headwinds

Inflation

Inflation effectively works like a tax on your capital, lowering your total return. Realizing this can make an investment in an annuity much less attractive because, at least in real terms, many investors will experience a real loss. This makes them even less attractive to the majority of people buying annuities who are retirees who will be using the payments to live on and may need their investment to last for a long time. Jackson specializes in this type of investing and has several risk management techniques to mitigate these risks, but basic inflation risk will remain on many investors’ minds.

Asset market decline

Falling prices in the asset market will prove to be a headwind for Jackson for two reasons. The first is that the company’s stock price will struggle to rise when the overall market is down. This is especially true with a high percentage of institutional owners who may be looking to sell to strengthen their balance sheets. The second is the effect of falling bond and mortgage prices. These constitute the majority of the assets held and are mostly hedged. However, if you look at their earnings presentation, if we start to see a slump in risk assets instead of the orderly selling that we’ve had, that will be negative.

conclusion

Jackson Financial is the most profitable company in its industry, growing double digits, maintaining a strong balance sheet and expecting to return between 17% and 21% of the company to shareholders. This company will experience earnings volatility and I expect fluctuations in the share price as institutions continue to accumulate and sell stocks. Over the long term, I think the setup is there for Jackson to deliver significant returns to shareholders. For these reasons, I again rate Jackson Financial as a solid buy.