Techa Tungateja/iStock via Getty Images

After our recent update on Aviva (AIVAF, OTCPK:AVVIY), today we move on to another UK entity called Group Legal & General Plc (LGGNF, OTCPK: LGGNY). The company operates through four divisions:

- Legal and general retirement,

- Legal and general management of investments,

- Legal & General Capital,

- Legal and general insurance.

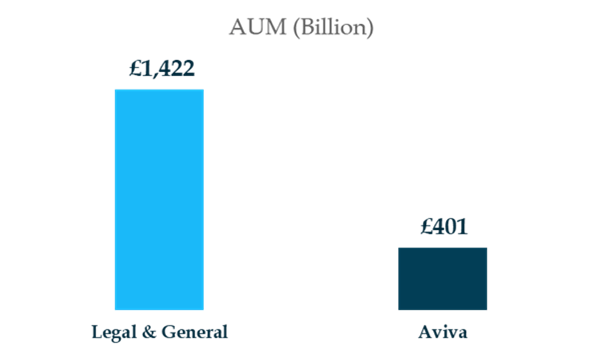

With over £1 trillion in assets under management (£1.4 trillion to be precise), L&G is one of the largest investment management companies in Europe. Their business is not only focused in the UK, but also in the US and internationally. Legal & General Group used to be an insurance company, but currently most of the revenue comes from its Investment Management arm. The agreement to sell its insurance business was first announced in 2019, and in 2020 the group sold the remaining part of the L&G general insurance business to Allianz.

There are 3 main reasons why we prefer Legal & General over Aviva:

- The positive trend of dividend growth, with an attractive yield;

- The advantage in ROE due to the diversification of segments and synergies;

- A very synergistic Asset Management activity that allows them to reinvest in very attractive Alternative asset classes, including Real Estate.

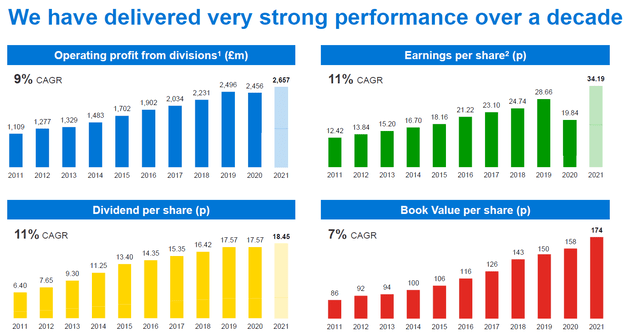

Now, someone might think that due to the large yield, the company has experienced stagnation in performance. This is not the case. L&G is a well-run company with a solid track record of profitability over the years.

L&G performance (L&G 2011 – 2021)

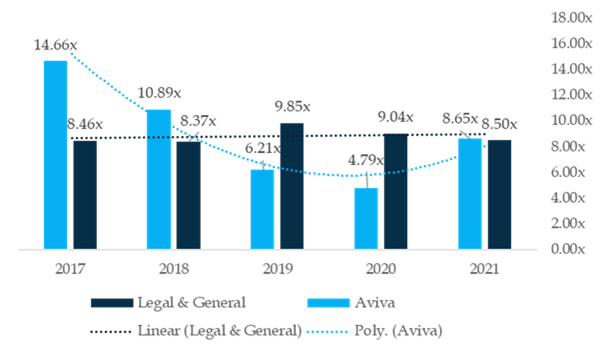

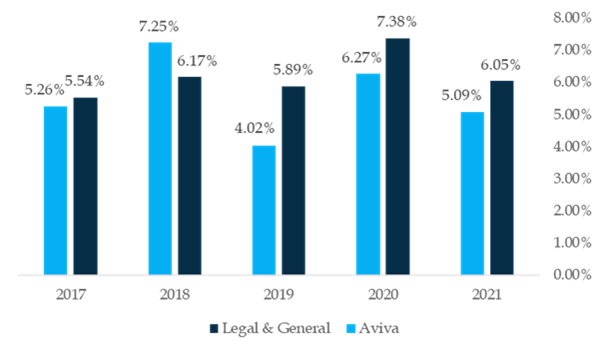

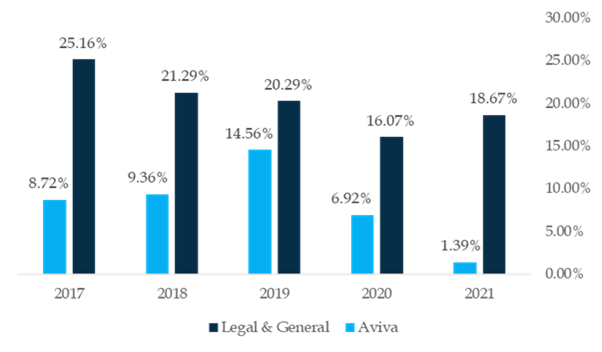

Returning to the analysis of the comps, we notice the following:

- L&G has had a more stable P/E ratio over the years thanks to the business mix compared to Aviva;

- Higher dividend yield over the past three years and no suspension of payment for the COVID-19 pandemic.

PE L&G v Aviva (Mare Evidence Lab PE Analysis)

Div. L&G vs. Aviva performance (Mare Evidence Lab Dividend Yield Analysis)

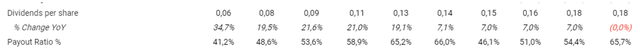

Below, thanks to TIKR, we can see the evolution of the DPS from 2011 to 2020.

In terms of the evolution of ROE over time, the different sector mix is key to Legal & General’s outperformance versus Aviva.

From a net income perspective, the argument for stability still holds, with L&G averaging £1.85bn over the review period. This creates, in our view, the number one condition to sustain the expected dividend growth. The reason for stability is further reinforced by client retention, which management says typically spans at least 40 years and trickles down to other asset management segments that have an average lifespan of 15 years old.

ROE L&G vs. Aviva (ROE analysis from Mare Evidence Lab)

As already mentioned, Aviva is a pure insurance player with higher SRII requirements, while L&G mainly focuses its activities on asset management. Please see the latest AuM in billions of pounds below.

AuM L&G vs. Aviva (Mare Evidence Lab AuM)

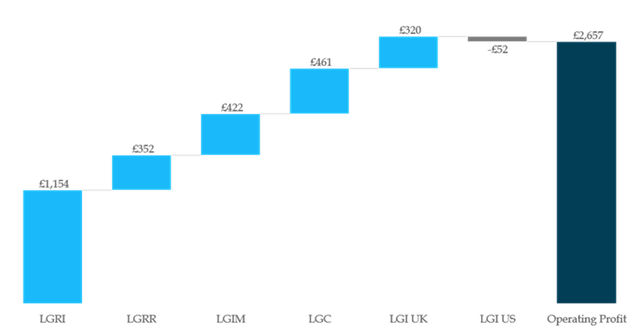

From a sector perspective, this difference in revenue sources is the main reason for the different returns. The most important elements that make up the operating result of Legal & General are:

- The institutional retirement solution which is essentially their internal cash cow;

- Followed by retail retiree segment;

- The Asset Management arm which is deeply synergistic with its own retirement solution, the highly attractive LGC Asset Creation, which deals in alternative assets including clean energy infrastructure, private credit and commercial real estate;

- The LGIs split between the UK and the US are life insurance and residual contributors.

L&G 2021 operating profit by segment

Conclusion and main risks

With a very consistent outlook, we value the business with a DCF model to capture the medium to long-term growth story. Using L&G’s investment in pension risk transfer and future cash flow forecasting, our internal team used L&G’s capital generation and arrived at a value of £3.5 per share, versus the current market price of £2.7 per share. Finally, the generous and stable dividend offered by the company is currently yielding over 7% at the time of writing.

Main risks weighing on our target price:

- Weak macro developments;

- Investment market risk, in particular credit risk

- Regulation after Brexit