Continuing post-COVID-19 demand growth, direct individual life insurance premiums from U.S. life insurers rose 2.5% year-over-year in the second quarter to $41.37 billion of dollars.

However, direct premiums for group life insurance fell 3.0% to $9.85 billion from $10.15 billion a year earlier.

Combined individual and group direct premiums were $51.21 billion in the second quarter, up slightly from $50.49 billion in the prior year period, but down from 52 .26 billion in the first quarter. The Life Insurance Marketing and Research Association, which conducts quarterly surveys of life insurance companies, said sales of indexed universal life insurance and variable universal life insurance drove overall premium growth in the second trimester.

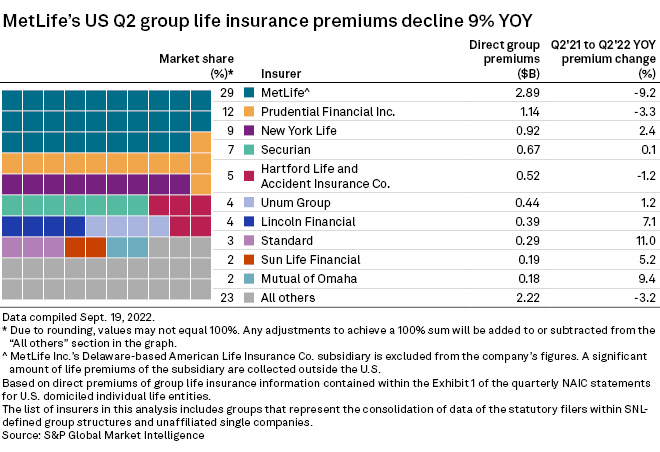

MetLife sees biggest group decline

Among the 10 largest underwriters of group life insurance in the United States, MetLife Inc. saw the largest decline in group life insurance premiums with a 9.2% drop to $2.89 billion. Despite this decline, MetLife remained the largest provider of group insurance premiums.

On an earnings call in August, MetLife chairman Ramy Tadros said the year-to-date sales decline was “largely a function” of the insurer’s record year. in 2021.

Premiums written were also down year over year for the second-largest group insurer, Prudential Financial Inc., falling 3.3% to $1.14 billion. Seven of the 10 largest group life insurers posted gains.

|

* Learn more about life market share during the first quarter of 2022. |

Individual market protection pellets

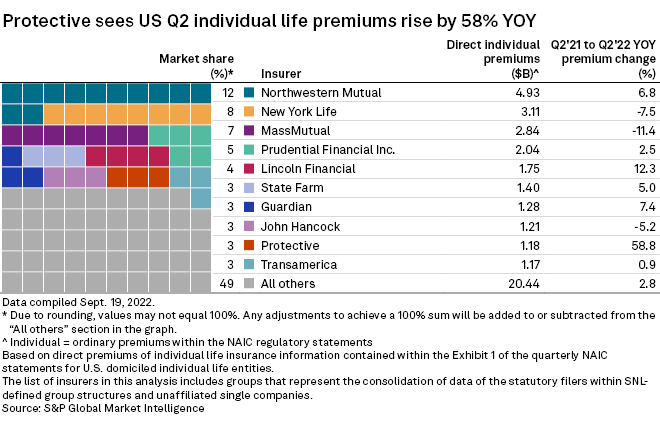

Among the 10 largest underwriters of individual life insurance, Protective Life Corp. saw the largest year-over-year change, increasing its individual premiums by 58.8%, followed by Lincoln National Corp. , whose individual premiums increased by 12.3%.

In 2019, Protective entered the bank-owned/corporate-owned life insurance, or BOLI/COLI, business after acquiring the life insurance and U.S. annuities from Great-West Lifeco Inc. According to Protective’s supplemental schedules for the first and second quarters, the company’s BOLI/COLI sales totaled $1.35 billion in the first half of 2022, compared to $519 million in the first semester 2021.

Three of the 10 largest individual life insurance underwriters saw year-over-year declines in individual premiums, the largest of which was an 11.4% drop in the second quarter of 2022 for Massachusetts Mutual Life Insurance Co.

New York Life Insurance Co. and John Hancock Life Insurance Co. (US) also fell year-on-year, falling 7.5% and 5.2% respectively.