An investment in health insurance company UnitedHealth Group (A H) in times of uncertainty is probably a good idea because its activity is inelastic. It can outperform many companies, even in times of recession or inflation.

The multinational health care and managed insurance company has always rewarded its investors. It has high rates of income growth and dividends. In an environment where everyone is looking for the next safe investment, UNH stocks are worth considering. I am bullish on the stock.

UnitedHealth provides health and medical services worldwide. It has been around since 1977. In addition to insurance services, it also provides healthcare products.

UNH is a growth stock, and it does not trade at a significant premium to other stocks with less growth potential. To stay at the forefront of its increasingly competitive industry, it wishes to pursue new acquisitions and investments.

Its latest earnings report gives people plenty of reasons to consider investing in this stock. UNH experienced balanced growth in the second quarter as its business continued to expand. The most significant moves came from the strong expansion of UnitedHealthcare and Optum Health’s emphasis on value-based agreements.

UNH’s recent earnings report highlighted several strengths

UnitedHealth reported revenue growth of 13%, from $71.3 billion to $80.3 billion year over year. Operating profit was $7.1 billion, representing 19% year-over-year growth.

UNH reported second-quarter profits topped $5 billion, up from $4.27 billion in the second quarter of 2021. Its diversified portfolio of Optum health insurance plans and healthcare services helped it to outperform its competitors.

UnitedHealthcare treated 280,000 more people than the previous year, and the number of patients served has increased significantly in recent years.

UnitedHealthcare saw revenue grow 12% from membership expansion, from $55.5 billion to $62.1 billion. For health insurer Optum, revenue per patient increased by 30% over the same period. It saw growth in value-based care arrangements and continued growth in its services offered that year.

Optum recorded double-digit growth in the second quarter due to a growing customer base and the expansion of its pharmaceutical care services, including specialty and community pharmacies. In the second quarter, Optum had revenue of $45.1 billion and had a year-over-year growth rate of 18%.

The company is excited about the growth it expects for this year. Its performance in the first half allowed it to increase its EPS estimates, which should translate into higher adjusted EPS. The respective ranges for annual and adjusted net earnings are $20.45 to $20.95 per share and $21.40 to $21.90 per share.

What UNH is doing to grow

UNH has prioritized growth over the past three years. Her focus is on acquisitions, which has helped her grow her business and reach new people around the world.

UnitedHealth Group recently acquired Refresh, a private Florida mental health and addiction treatment company, on undisclosed financial terms. Advanced Health Services also puts UnitedHealthcare in a unique position to manage its customer base.

By operating a network of 300 outpatient mental health, addiction and eating disorder centers, the company ensures that healthcare is accessible to anyone who needs it.

In June, the UNH subsidiary acquired EMIS Group plc (EMIS), a UK-based health technology company, in an all-cash deal valued at approximately $1.51 billion. UnitedHealth acquired Optum to provide healthcare services in the UK. Not only will this strengthen an already strong presence, but it will also align with the country’s healthcare system.

Optum will continue to grow this year, through acquisitions, cutting-edge technology and accessible care. Each individual segment is expected to help drive the growth of the overall segment with strong performance.

Optum has launched a lab benefit management solution that helps health plans reduce unnecessary lab tests. The company expects the new product to generate savings of approximately $12 to $36 per member or more than $3 billion in annual savings for the company.

Despite tough years, UnitedHealth is one of the few healthcare companies with a thriving global business. Its main markets are recovering and membership is increasing. However, its continued growth is attributable to an aggressive expansionary approach, which should continue to pay investors for several years.

UnitedHealth: a stock with strong dividend growth

UnitedHealth started in 1974 and is one of the largest health insurance providers. Today, its products and services help tens of millions of people access healthcare globally.

Not only does it have large scale and customers with high switching costs, but it is also entrenched in its industry. For the healthcare company, this makes it much easier to raise dividends. It also creates a significant competitive advantage over other companies that don’t offer these benefits.

Most recently, the managed healthcare company increased its dividend by 13.8%. The quarterly cash payout of $1.45 to $1.65 per share is the increase that was announced in June, reaffirming its status as a blue-chip dividend stock.

As mentioned, UnitedHealth’s dividend looks ultra-safe today and it represents less than a third of UNH’s revenue. The company has great flexibility when it comes to returning capital to shareholders because its windfall profits are so high.

Wall Street’s view on UNH stock

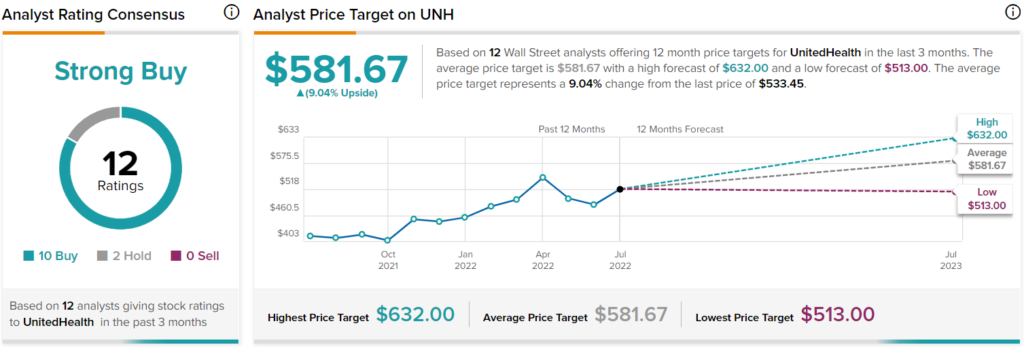

The sentiment surrounding UnitedHealth is bullish. UNH has a strong buy consensus rating based on 10 buys and two takes. The average UNH price target is $581.67, implying 9% upside potential.

UnitedHealth: One of the safest choices for a volatile market

The market is volatile. Therefore, investors are looking for safe investments. Market volatility makes it difficult to find a long-term investment that offers a stable return.

UnitedHealth is a well-established company that has been around for years. It has excellent finances and a great track record of sustainable returns, allowing you to invest with relatively less stress.

Disclosure