[ad_1]

American International Group had a strong second quarter for its Life and Pensions group as it plans to split this division into its own entity with Blackstone as the minority owner in an initial public offering in the first quarter. 2022.

AIG’s Life and Retirement unit reported pre-tax profit of $ 1.1 billion, up 26% from the second quarter of 2020, which hit the company with the first effects of COVID-19.

In addition to improving pandemic conditions, returns on private equity investments, higher commission income, and improved sales of variable and indexed annuities also helped improve performance. Fixed index annuities led the increase, accounting for $ 700 million of the gain, and variable annuities with $ 365 million.

AIG announced in July that it would sell 9.9% of the life and retirement business to Blackstone. Peter Zaffino, who became president and CEO in March, said Blackstone would help this new company grow.

“The strategic partnership with Blackstone further positions life or retirement to expand its distribution relationships, enhance its product offerings, and the company will benefit from Blackstone’s significant capabilities,†Zaffino said on a call with analysts.

In addition to the $ 2.2 billion agreement, Blackstone will enter into “a long-term strategic asset management relationship to manage specified assets in the General Life and Pensions account in the future and has agreed to acquire the Life & Retirement interest in an affordable housing portfolio in the United States for approximately $ 5.1. billion.”

Blackstone will manage $ 50 billion in specific asset classes, rising to $ 92.5 billion over six years. Jonathan Gray, President and COO of Blackstone, will join the IPO entity’s board of directors upon the close of the equity investment, which AIG plans to have in September.

In its overall performance, after-tax profit was $ 1.3 billion, or $ 1.52 per diluted common share, more than double the $ 561 million, or $ 0.64 per diluted common share, said the company in the second quarter of 2020.

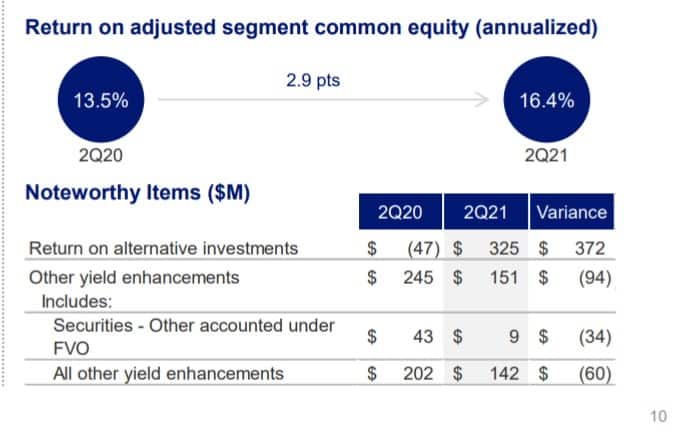

In addition to annuity income, AIG attributes the growth to the favorable impact of the equity market, resulting in higher alternative investment returns, mainly due to the strong performance of private equity. Additionally, the company cited higher fee income, partially offset by higher variable annuity reserves, as market returns in the previous year’s quarter were higher than market returns in the quarter. of the current year.

Alternative ROIs saved what would otherwise have been a down quarter.

The life insurance business posted adjusted pre-tax profit of $ 20 million, up from $ 2 million a year earlier, largely reflecting the decline in deaths from COVID-19.

As for individual and group pensions, net flows were negative by $ 306 million. Excluding retail mutual funds, individual retirement recorded net inflows of $ 556 million compared to net outflows of $ 684 million in the prior year quarter, largely due to the recovery from the related disruptions. to COVID-19.

The sale of 12 mutual funds from AIG Life & Retirement to Touchstone Investments, a wholly owned subsidiary of Western & Southern Financial Group, was completed on July 16. Negative of $ 243 million in the prior year quarter, reflecting an increase in group acquisition deposits, partially offset by higher redemptions and withdrawals.

On the non-life insurance side, pre-tax income of $ 1.2 billion reflects improved underwriting results and higher net investment income. The combined ratio was 92.5, an improvement of 13.5 points from the previous year quarter, mainly due to lower catastrophe claims. The full year-adjusted P&C combined ratio was 91.1, an improvement of 3.8 points from the previous year quarter due to improved underwriting results for international business lines and North America.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has over 25 years of experience as a journalist and editor of newspapers and magazines. He was also vice president of communications for an association of insurance agents. Steve can be reached at [email protected].

© All 2021 content copyright by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the express written consent of InsuranceNewsNet.

[ad_2]