[ad_1]

Job losses caused by the coronavirus pandemic have threatened to disrupt health coverage for millions of people, as most working-age adults have coverage for themselves and their families through their work. Real-time changes in coverage and the rate of the uninsured are difficult to follow with much precision because the large national surveys that produce these estimates are lagged by several months or years, and private surveys generally lack a sufficient sample to accurately measure changes in coverage. Many real-time surveys have faced high rates of non-response (not responding to the survey or particular questions), especially among populations most likely to be affected by the economic downturn, including including the Census Bureau Household Pulse Survey. However, various administrative data sources allow us to reconstruct what might happen to health coverage rates in the midst of the pandemic.

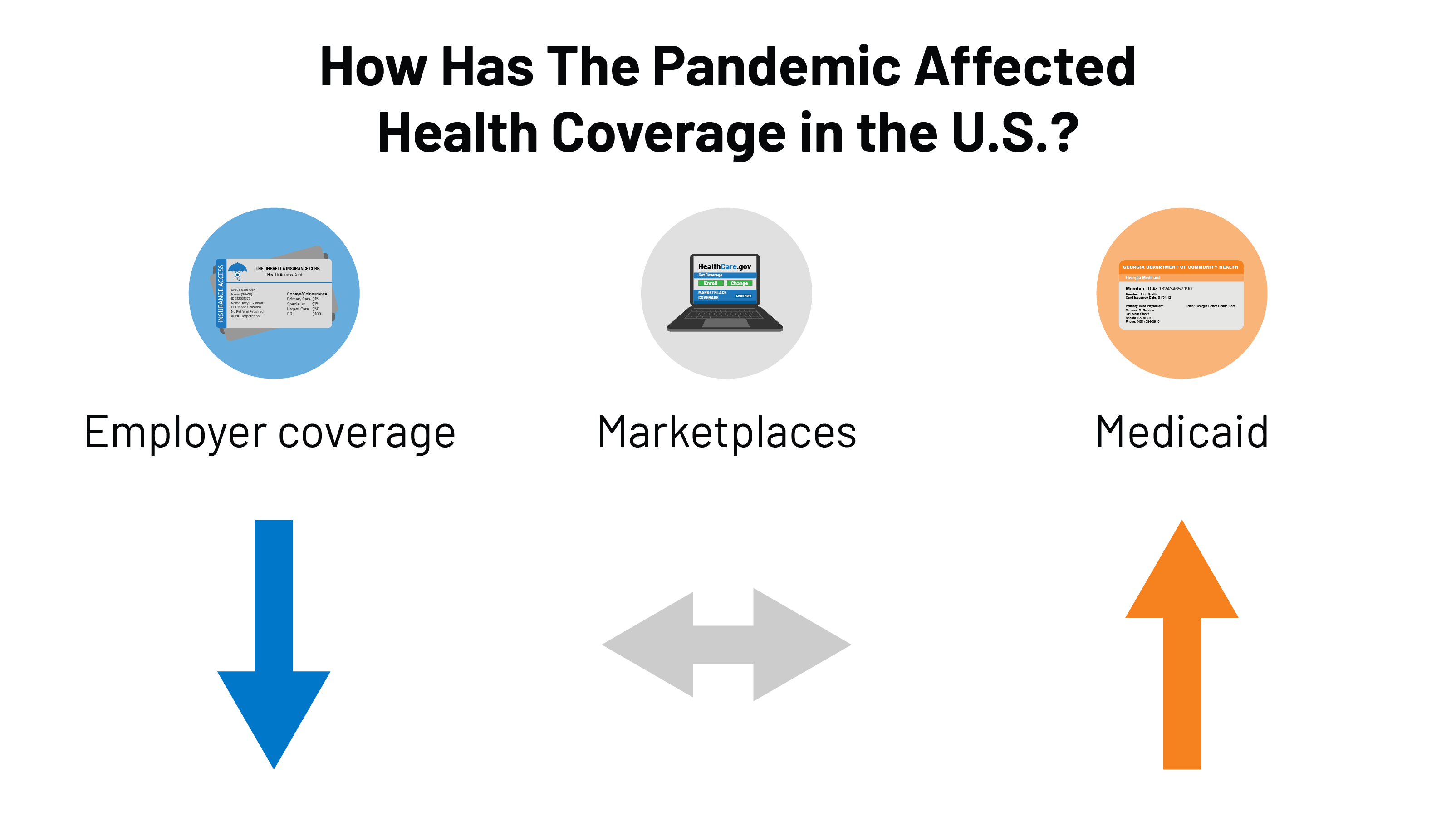

Declines in employer sponsored insurance are much smaller than overall declines in employment. First, using the insurers administrative data file with state regulators (compiled by Mark Farrah AssociatesTM), we can see how employer plan enrollments have changed through the end of September. Although employment rates fell 6.2% from March to September, market registrations for fully insured groups fell only 1.5% over the same period.

If we extrapolate this result to the entire collective market, including self-insured employer plans, it would suggest that around 2-3 million people in total may have lost their employer’s coverage between March and September. To be very clear, this is only a rough estimate. We do not have reliable data for self-insured employers (which insure about 6 in 10 people with employer coverage and tend to be larger), and these employers may have made different decisions than fully insured employers regarding layoffs and if and how to maintain coverage for employees.

The loss of employer-provided coverage may have been offset by strong adherence to Medicaid and Marketplaces. Many of those who lost employment-based health coverage would have qualified for Medicaid or a special enrollment opportunity to purchase individual market health coverage (either on the stock exchange or over the counter). Preliminary administrative data from the Medicaid program shows enrollments increased by 4.3 million people (6.1%) from February to July 2020. More recent data for 30 states shows enrollments in managed care plans increased approximately 5 million, or 11.3%, from March to September 2020. Nationally, OLS covers more than two-thirds of Medicaid beneficiaries. States attribute these increases to rising unemployment (and the loss of employer-sponsored insurance) as well as “continued eligibility” (MOE) requirements linked to a 6.2 point increase. percentage of the federal match rate (FMAP) allowed by the Families First Coronavirus Response Act (FFCRA) – which prevents states from deregistering Medicaid recipients if they accept additional federal funding.

Using the same administrative data above (from Mark Farah Associates TM), we find that individual market listings were quite stable from March to September 2020. In normal years, there is usually more attrition in the market. during these months as more people leave the market than come during Special Enrollment Times (SEP). However, SEP registrations were higher this year in Healthcare.gov and state-based exchanges.

While much is unknown, a review of administrative data suggests that the rate of uninsured may not have changed much during the pandemic to date. There is still a lot we don’t know, and this administrative data does not take into account other changes like the aging of people towards Medicare and population growth. Nonetheless, it appears that the decline in employer-sponsored health insurance coverage may have been offset by gains in Medicaid and largely stable enrollments in the personal market.

There are several possible explanations for the relatively modest decline in employer coverage despite massive job losses. First, many of the people who lost their jobs were probably never covered by their jobs; low-wage workers are less likely to be covered by their employer’s plan, and similarly, job losses have been the highest and longest-lasting among industries that tend to have supply rates lower coverage (eg retail, services, hospitality). Second, many people who lost their jobs were able to temporarily keep their health coverage. A number of employers have chosen to keep on leave or laid off workers enrolled in their company plan for at least the short term. Additionally, an unknown number of permanently laid-off employees may have chosen COBRA (which would be classified as group coverage) at their own expense, although this number is likely low due to the high costs of such coverage. Employment rates are starting to pick up, but more of those filing unemployment claims say their job loss is permanent compared to earlier in the pandemic, suggesting there could be more loss of coverage to come.

The fact that the uninsured rate has not changed substantially this year could be seen as both good news and bad news. A largely stable uninsured rate would be good news as health insurance coverage rates tend to drop whenever there is an economic downturn in the United States. Between many employers maintaining coverage and the Affordable Care Act as well as Medicaid serving as a safety net for those who have lost coverage, the uninsured rate in the United States does not appear to have increased as much as it would have. pu, given the scale of employment. losses.

The bad news is that while the uninsured rate has indeed held up, tens of millions of people still remain without health coverage during the worst pandemic to hit the country in a hundred years. Despite some recent legislative and administrative measures to protect uninsured people from some of the costs associated with COVID-19 testing and treatment, people without coverage still face enormous financial and health risks.

Four in ten people who were uninsured before the pandemic could get free health insurance coverage, either through Medicaid or through a zero-premium bronze plan on the exchange. Open enrollment for 2021 coverage in the ACA exchange markets is now in its fifth week and early figures show that while overall enrollment is strong, new enrollments are about the same than in previous years. The Trump administration has dramatically cut funding for ACA’s outreach and marketing activities, as well as browsers that help people sign up for Marketplace coverage. President-elect Biden has pledged to restore funding for ACA’s marketing, outreach and navigation programs. The federal open enrollment period will have ended by the time Biden takes office, but he could open a new SEP with no limitation on who qualifies to enroll.

[ad_2]