[ad_1]

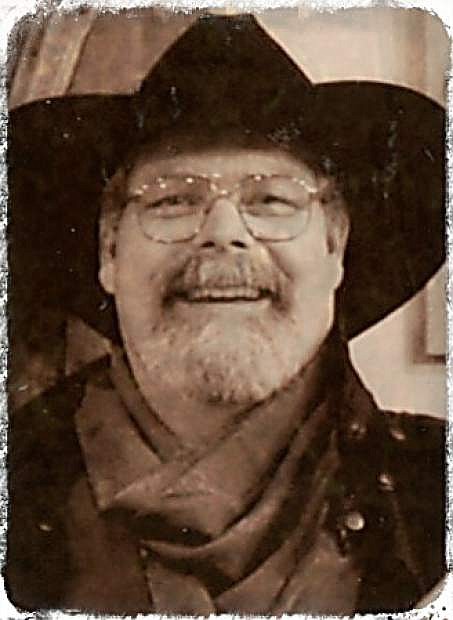

Kelly bullis

Saturday July 17, 2021

In these turbulent times when the stock market is going up… going up… going up. Someone once said, “What goes up must come down.” Does this possibility prevent you from staying in bed at night with your eyes wide open?

Well, I’ve been told that I’m actually a “sleep expert” and here’s an idea that might help you sleep better.

It’s called “Turning an IRA into an Annuity”.

Basically, when you reach that magical “minimum distribution required†age (currently 72), you must withdraw a certain amount from your IRA each year, regardless of the market. You might end up having to withdraw money when the market has fallen, which is tantamount to withdrawing a larger amount in the long run. An annuity, on the other hand, provides something like “insurance” on your retirement investment. How? ‘Or’ What? By providing protection in a declining stock market, guaranteed income for life and the ability to secure a certain amount are passed on to your heirs.

My preferred choice of annuity is a “variable annuityâ€. This gives some protection against inflation and rising interest rates. (Usually higher fees are associated, but I think it’s worth it.) Other professionals prefer “fixed annuities†because they are more reliable as an income stream.

Basically, turning an IRA into an annuity is a tax-free process. Annuities that are funded by an IRA rollover are “qualified” plans. This allows insurance companies to create “IRA annuities” into which an investor can directly deposit their retirement funds. Better yet, the annuity funds will continue to grow tax-deferred.

A good strategy is to delay annuity payments as long as possible. The smaller the number of years over which an annuity is paid, the higher the monthly amount paid. Keep in mind that this is technically still an IRA, which means you are still subject to the IRS minimum required distribution rules. So, you cannot delay your payments once you are 72 years old.

Who makes these kinds of “IRA annuities?” »Just about all major life insurance companies.

One drawback to taking this option. It is irreversible. By rolling your IRA funds into an immediate annuity, you are giving up access to capital in exchange for guaranteed income. MAKE SURE you want to do this before you do it. Always consult with a trusted and knowledgeable advisor before doing anything like this.

Did you hear? Prov 28:26 says: “He who trusts in himself is a fool; but he who walks in wisdom is protected.

Kelly Bullis is a Chartered Accountant in Carson City. Contact him at 882-4459. On the web at BullisAndCo.com. Also on Facebook.

[ad_2]