[ad_1]

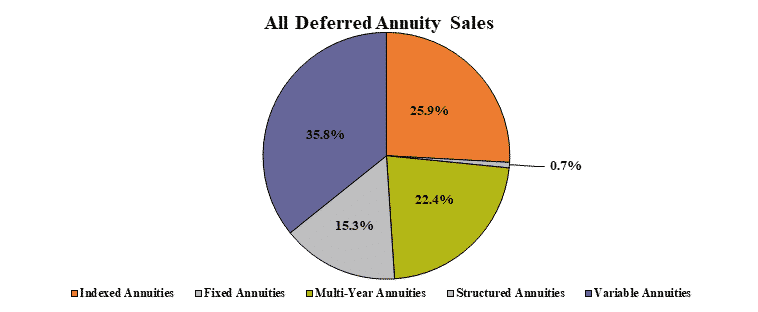

Total second-quarter sales for all deferred annuities were $ 64.4 billion, an increase of more than 10% from the previous quarter, according to Wink’s sales and market report.

Sales represent a 40.4% increase over the same period last year, Wink reported.

Total deferred annuities include variable annuities, structured annuities, indexed annuities, traditional fixed annuities and MYGA product lines.

Notable highlights for all second quarter deferred annuity sales include Jackson National Life as the # 1 carrier for deferred annuity sales, with a 7.5% market share. AIG moved up to second place, while Equitable Financial, Allianz Life and New York Life respectively round out the top five carriers in the market.

Jackson National’s Perspective II flexible-premium fixed and variable deferred annuity, a variable annuity, was the best-selling deferred annuity, across all channels combined in overall sales for the tenth consecutive quarter.

Total sales of non-variable deferred annuities in the second quarter were $ 31.5 billion, up 11.1% from the previous quarter and 22% from the same period last year. Non-variable deferred annuities include the indexed annuity, the traditional fixed annuity and the MYGA product lines.

Notable highlights for second quarter deferred non-variable annuity sales include AIG’s ranking as the number one carrier overall for non-variable deferred annuity sales, with a market share of 8.1%. Global Atlantic Financial Group moved up to second place, while Massachusetts Mutual Life Companies, New York Life and Allianz Life completed the market’s top five carriers, respectively.

The Allianz Benefit Control Annuity, an indexed annuity, was the best-selling non-variable deferred annuity across all channels in overall sales for the second consecutive quarter.

Total sales of variable deferred annuities in the second quarter amounted to $ 32.9 billion, an increase of 9.4% from the previous quarter and an increase of 63.5% from the same period. last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Notable highlights for second quarter variable deferred annuity sales include Jackson National Life as the number one carrier for variable deferred annuity sales, with a market share of 14.6%. Equitable Financial retained second place, while Lincoln National Life, Nationwide and Brighthouse Financial respectively entered the market’s top five carriers.

Jackson National’s Perspective II flexible premium fixed and variable deferred annuity, a variable annuity, was the best-selling variable deferred annuity, for all channels combined in overall sales for the tenth consecutive quarter.

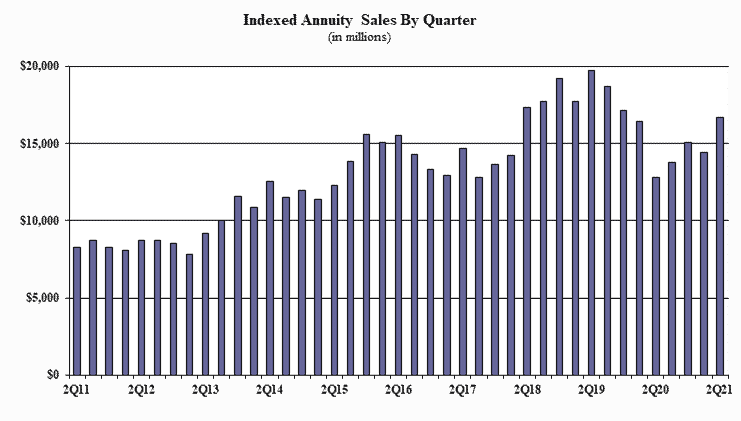

Sales of indexed annuities for the second quarter were $ 16.6 billion, up 14.5% from the previous quarter and 29.9% from the same period last year. Indexed annuities have a floor of at least zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Notable highlights for indexed annuities in the second quarter include Allianz Life as the # 1 seller of indexed annuities, with a market share of 10.7%. Athene USA moved up to number two while AIG, Fidelity & Guaranty Life and Sammons Financial Companies respectively rounded out the top five carriers in the market.

Allianz Life’s Allianz Benefit Control Annuity was the best-selling indexed annuity across all channels for the third consecutive quarter.

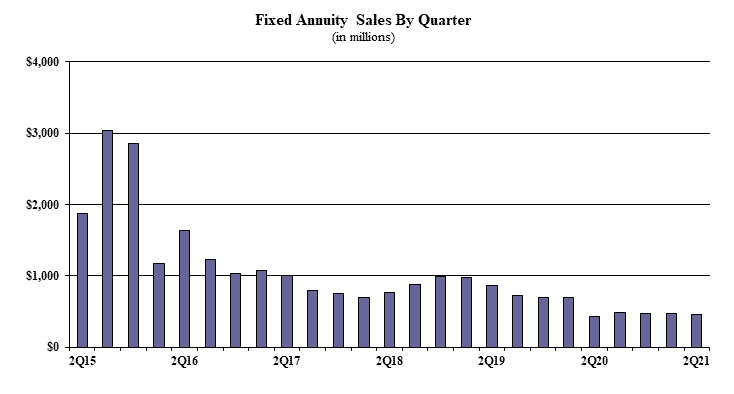

Second quarter traditional fixed annuity sales were $ 462 million. Sales were down 3.1% from the previous quarter and up 8.5% from the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for only one year.

Notable highlights for traditional fixed annuities in the second quarter include Modern Woodmen of America as the number one fixed annuity carrier, with an 18.4% market share. Global Atlantic Financial Group ranked second, while Jackson National Life, American National and EquiTrust respectively completed the top five carriers in the market.

Forethought Life’s ForeCare Fixed Annuity was # 1 in fixed annuity sales across all channels for the fourth consecutive quarter.

Sheryl Moore, CEO of Wink, Inc. and Moore Market Intelligence: “Unfortunately, fixed annuities with a one-year guaranteed rate have been a victim of the low interest rate environment. That aside, we’re on track to make 2021 the best year ever for overall annuity sales. “

Second quarter multi-year guaranteed annuity (MYGA) sales were $ 14.4 billion, up 8.6% from the previous quarter and 15.2% from the same period per year. latest. MYGAs have a fixed rate guaranteed for more than one year.

Notable highlights for MYGAs in the second quarter include New York Life’s ranking as the number one carrier, with a 13% market share. Massachusetts Mutual Life Companies took second place, while Global Atlantic Financial Group, AIG and Western-Southern Life Assurance Company respectively completed the top five carriers in the market.

Massachusetts Mutual Life’s Stable Voyage 3-Year was the best-selling multi-year guaranteed annuity for all channels combined.

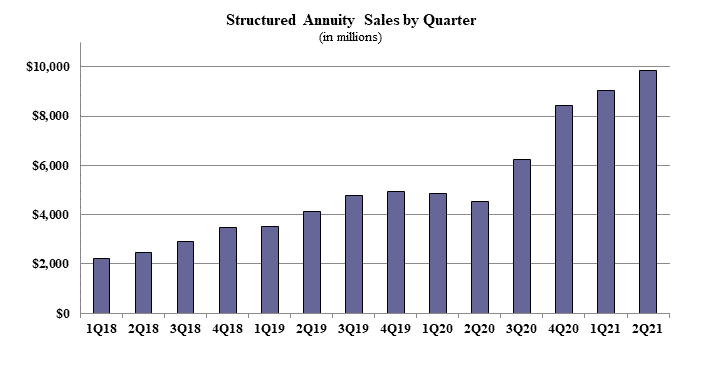

Second quarter structured annuity sales were $ 9.8 billion, up 8.9% from the previous quarter and 117.9% from a year ago. Structured annuities have a limited negative floor and limited excess interest which is determined by the performance of an external index or sub-accounts.

Notable highlights for structured annuities in the second quarter include Equitable Financial’s ranking as the leading carrier in structured annuity sales, with a 19.3% market share. Allianz Life placed second, while Lincoln National Life, Brighthouse Financial and Prudential respectively rounded out the top five carriers in the market.

Equitable Financial’s Structured Capital Plus strategies were the best-selling structured annuity across all channels combined for the second consecutive quarter.

“Structured annuities are definitely the darling of the deferred annuity market,†Moore said. ” Everyone does it. If a company doesn’t sell it today, they’re doing R&D on it. Structured annuities are here to stay.

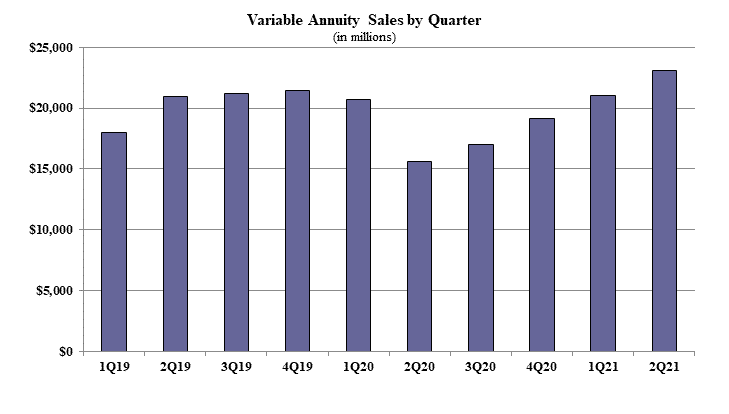

Sales of variable annuities in the second quarter were $ 23 billion, an increase of 9.6% from the previous quarter and an increase of 47.8% from the same period last year. Variable annuities have no floor and a potential gain / loss which is determined by the performance of the sub-accounts which may be invested in an external index, stocks, bonds, commodities or other investments.

Notable highlights for variable annuities in the second quarter include Jackson National Life as the # 1 variable annuity carrier, with a 20.9% market share. Nationwide ranked second, while Equitable Financial, Pacific Life Companies and AIG respectively finished in the top five carriers in the market.

Jackson National’s Perspective II flexible premium fixed and variable annuity was the best-selling variable annuity for the ninth consecutive quarter across all channels.

Wink reports on the sales of indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity and multiple life insurance lines. Sales reports on additional product lines will follow in the future, Moore said.

Sixty-six indexed annuity providers, 46 fixed annuity providers, 70 multi-year guaranteed annuity providers (MYGA), 14 structured annuity providers and 43 variable annuity providers participated in the 96th edition of the Sales and Market Report. Wink for the 2nd quarter of 2021.

[ad_2]